Banking sector sound, stable: RBI Governor

| Date :05-Oct-2019 |

NEW DELHI

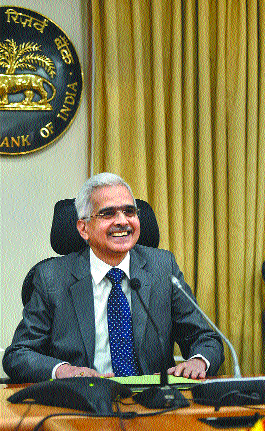

DAYS after the PMC Bank came under scanner for alleged frauds, the RBI Governor Shaktikanta Das on Friday said that all was well with the banking system and one incident could not reflect the health of the overall system.

He advised the public and depositors to not believe in rumours.

Shaktikanta Das

“The Indian banking sector remains sound and stable and there is no reason for any unnecessary panic. In fact, sometimes unnecessary rumours can create panic situation,” Das said.

In recent days, large scale frauds have been reported at the Punjab and Maharashtra Cooperative (PMC) Bank creating panic among its account holders. In another case involving private lender Lakshmi Vilas Bank, the RBI has initiated Prompt Corrective Action (PCA) putting them under regulatory restrictions. The extreme step was taken due to high level of bad loans, lack of sufficient capital and poor asset quality.

The RBI Governor listed out various measures taken to address the issues involving the PMC and Lakshmi Vilas Banks. He stressed that swift actions had been taken in both the cases. On apprehensions that many more co-operative banks could be involved in violation of banking regulations and hence depositors have reasons to worry, the RBI said that there was no need to believe such rumours.

“One incident can not be used and should not be used to generalise the health of the co-operative banking sector,” Das added.

‘Not aware’ of interim dividend demand from Centre, says Das: RBI Governor Shaktikanta Das saidthat he is not “aware of any demand of interim dividend” from the Central Government. The Governor’s assertion comes after some reports suggested that Government may seek an interim dividend of Rs 30,000 crore from the apex bank. Accordingly, reports have off late suggested that Government may seek an interim dividend of about Rs 30,000 crore to meet its fiscal deficit target of 3.3 per cent of GDP for the financial year 2019-20. Replying to a media query on the issue, Das replied: “I also saw it in the media, not aware of any demand from the government on payment of interim dividend.”On Thursday, CARE Ratings had said that RBI may have to pay an interim dividend to the Government to support resource mobilisation along with revenues from disinvestments.