Despite policy efforts, half of Indian adults ‘credit unserved’: CIBIL report

| Date :26-Apr-2022 |

Business Bureau

AROUND 480 million adult Indians till the age of 65, representing half of the overall population in the earning segment, are ‘credit unserved’, as per a report by a credit information company.

An additional 164 million were classified as ‘credit underserved’ in the global study done by Transunion CIBIL, while only 179 million fit into the ‘credit served’ category.

Specific efforts are being taken by the policy apparatus to deepen the credit culture in the country to ensure that borrowers do not fall prey to usurious moneylenders. The Jan Dhan Yojana, which saw the opening of over 450 million accounts, has accounts that come with a credit overdraft facility. Only 3 per cent of US adults are credit unserved, while the number is 7 per cent in Canada, 44 per cent in Colombia and 51 per cent in South Africa, the report said.

“Although India has made great strides in increasing levels of credit inclusion across the country in recent years, the current reality highlights the importance of incorporating enriched credit data into the lending ecosystem, so that fewer consumers find themselves as credit unserved,” said Rajesh Kumar, the Managing Director and Chief Executive of CIBIL.

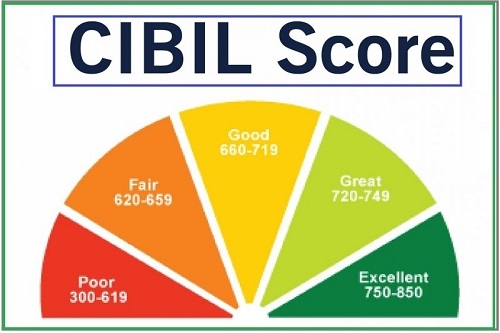

Admitting that it is a “chicken and egg” situation when it comes to unserved consumers, the report said a lack of credit score and credit history for unserved consumers is an impediment for getting credit opportunities, as lenders are hesitant to extend loans without any credit history or score.

The study found that about 5 per cent of consumers who started as credit underserved were found to have migrated to becoming more credit active in a two-year window.

The underserved consumers are those who have minimal credit participation, limited to a single type of credit product and no more than two open accounts of that type, and have been active in the credit market for at least two years, it said. It specifically excluded newly acquired consumers -- those who have opened their first product within the past two years, the report said.