World Savings Day Special

| Date :30-Oct-2025 |

By Tanisha Jaiswal :

World Savings Day is celebrated in India on October 30 every year. In India, it aims to spread awareness about the importance of saving money and using it wisely. The day encourages people to develop good saving habits for a secure and better financial future.

From saving coins in kitchen jars to trading stocks on mobile apps – Indians have come a long way. The shift from traditional saving to smart investing marks a new era of financial confidence and global ambition.

With changes in time and economy, the saving patterns of Indians are also changing from traditional saving jars to smart investments and rising to the global stage.

The concept of savings dates back to the early 20th century, when people were urged to save money in banks rather than hiding it at home.

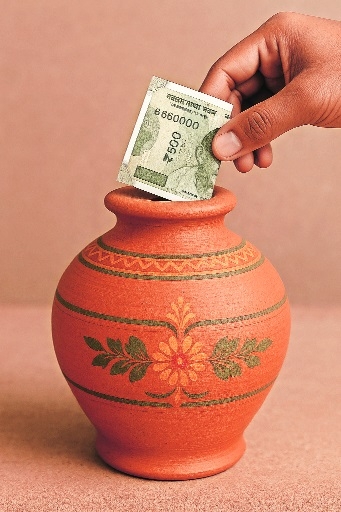

In earlier times, it was common for households to stash cash in utensils, earthen pots, or under mattresses, simple yet risky methods of safekeeping. With the evolution of the banking system, such practices gradually faded as people began to understand the benefits of secure savings and interest accumulation.

Today, the world of saving has transformed dramatically. From fixed deposits and recurring accounts to mutual funds, digital wallets, and online banking, modern technology has made saving and investing both easier and more efficient. Many young individuals now explore financial markets, investing in stocks, mutual funds, and cryptocurrencies, opportunities that were once unimaginable to the older generation.

“Back in our days, people trusted only what they could see and touch,” said 65-year-old homemaker Sudha Lanjewar. “I remember my mother keeping her savings in a steel box hidden in the kitchen. Banks were seen as a luxury, not a necessity.”

While older generations valued tangible security, the younger population is driven by awareness and access. “Saving is no longer about just putting money aside; it’s about growing it,” said 28-year-old Bank’s Deputy Manager, Om Khobragade. “I invest in SIPs, life and health insurance and stocks regularly. Financial apps make it easy to track everything, and I feel more in control of my future.”

For many in their middle years, balancing traditional and modern saving habits offers stability.

“Saving isn’t just about money, it’s about security, I prefer having both fixed deposits for safety and mutual funds for returns, this mix keeps me secure while ensuring my money works for me,” shared Nitin, a marketing agent.

World Thrift Day emphasises the importance of saving for emergencies, education, retirement, and long-term dreams, and it continues to remind people that while times may change, the value of thrift remains timeless.

Whether through coins in a pot or investments on a digital platform, saving ensures a safer, more confident tomorrow for all. And the key to savings is to start as early as possible in life to smoothen the hard road ahead, say the wise men.