No takers for 7 properties of Wasankar

| Date :10-Dec-2019 |

EoW has freezed a total of 122 bank accounts of Wasankar Wealth Management Ltd, his relatives and employees

By Dheeraj Fartode :

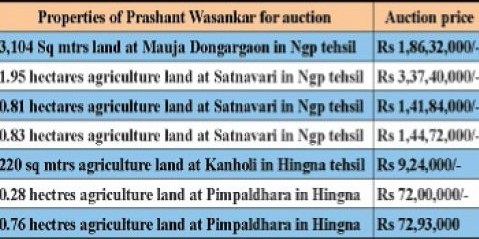

THE competent authority has failed to get suitable customers for seven properties of Prashant Wasankar, who duped hundreds of investors to the tune of Rs 236 crore. The properties include agriculture land in Hingna and Katol tehsil. As they are situated in the interior, not many are interested in purchasing the land citing reason of overvaluation. Till date, out of 19 properties notified by the court, the authority has managed to sell 11 properties for Rs 4.68 crore. First auction of assets belonging to Wasankar was held in November 2017 in which eight properties were sold for Rs 4.44 crore. Second auction was organised in January 2018 in which four properties were purchased by investors. “The valuation was done by the Sub-Registrar as per rates of year 2017,” the official said. In October 2019, Nagpur Bench of Bombay High Court had given extension of six months to the MPID court to dispose of the matter. MPID court would pronounce verdict in April next year.

Sources informed that a total of 858 complainants were struggling to get back their hard-earned money. “As per the detailed calculations, these complainants should get Rs 236 crore from Wasankar including rate of interest on their investment and policies promised by the group,” claimed sources. The Economic Offences Wing has freezed a total of 122 bank accounts of Wasankar Wealth Management Ltd, his relatives and employees. These accounts were used by Wasankar to rotate the money of investors. As many as Rs 30.58 lakh were freezed in the account by the EoW.

Reliable sources claimed that 10 properties of employees of Wasankar were also on the radar of EoW. These properties would be auctioned after getting approval from the court. The employees were very close to Prashant Wasankar and played important role in making huge investments in the dubious scheme by offering mind-boggling returns and interest. EoW has have recovered Rs 30 crore in year 2016 including Rs 17 crore cash and properties worth Rs 13 crore. After adding this anonymous properties recovery has reached Rs 40 crore.

Due to massive publicity campaign and prompt repayment, during initial phase thousands of people invested their hard-earned money with Wasankar. A majority of them were retired persons who parked their life-long savings. In 2012-13, flow of investors shrunk as two other companies using almost identical modus operandi run by Jayant and Varsha Zambre of J S Financial Services and Shree Surya group run by Sameer and Pallavi Joshi, went bankrupt leaving thousands in lurch. Later, Wasankar started giving excuses to investors as cheques started bouncing for want of funds and finally he was booked by police in May 2014.

Wasankar’s arrest was a big blow to hundreds of his investors and admirers who viewed him as some sort of financial wizard. Initially, a substantial number of investors mobilised support for Wasankar and termed the complainants as spoilsports, but later harsh reality surfaced and many of them quietly filed complaints.