I-T Dept mounts concurrent surveys in Korba, Jagdalpur

| Date :19-Mar-2019 |

The Hitavada State Bureau Raipur/Jagdalpur/Korba,

Four business premises covered in Jagdalpur, whereas three premises in Korba were enveloped under the I-T swoop

With 13 days remaining for the culmination of financial year 2018-19, Income Tax Department has stepped up its efforts to augment taxes to meet the revenue deficit for the government coffers. Under this drive, a team of tax sleuths from Assessment Wing of Income Tax Department on Monday afternoon mounted concurrent surveys on four business premises in Jagdalpur, the divisional headquarters of restive Bastar. Apropos, a separate team of taxmen from Bilaspur conducted searches in Korba, wherein they enveloped three business premises.

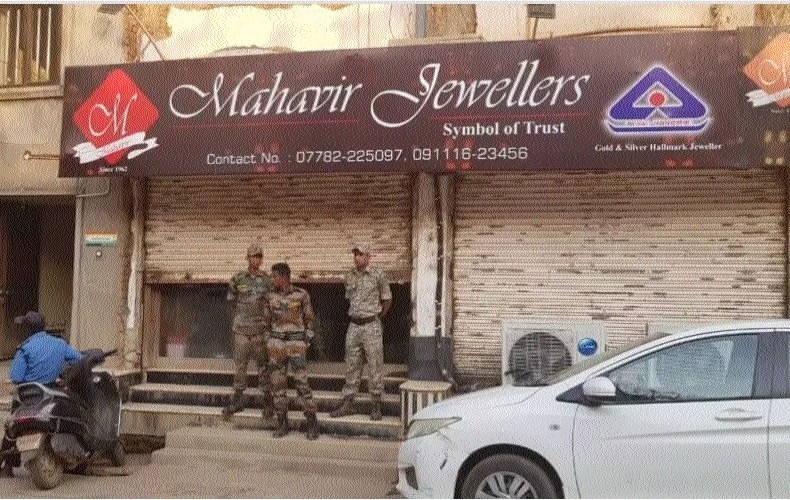

The surveys were likely to last for another day. Highly-placed sources averred to this newspaper reporter that tax enforcers, divided into different teams, launched survey operations on four business groups situated at different locations in Jagdalpur. “Buisness premises of M/s BAMS House situated at Motitalabpara, M/s Rathi Buildmart at Anupama Chowk, M/s Somani Cold Store and M/s Mahaveer Jewellers on Main Road have been covered under the survey,” the sources said. According to the sources, the local taxmen team reinforced with officers from Raipur were closely scrutinising incriminate paper and digital trails of financial transactions for traces of tax evasion. “We were scouring through heaps of documents and other modes of digital evidences retrieved from laptops, hard-drives and pan drives from these premises.

Tax evasion to the tune crores may come to fore, including the disclosure about ‘Benami’ properties accumulated through undisclosed income,” the sources revealed. Similarly in Korba, the Income Tax Department conducted surveys on M/s Pihu Fashion Mall, M/s Amrita Jewellers and M/s Gold Silver Centre. “The surveys conducted under Section 133 (A) of Income Tax Act were carefully planned and executed under the supervision of Principal Commissioner of Income Tax (PCIT) S K Singh whereas the real time operations were being overseen by Joint Commissioner of Income Tax (JCIT) Sanjay Kumar. The tax sleuths were accompanied by local police personnel so as to avert any resistance,” the sources added. Meanwhile, sources also affirmed that that the database of high-value transactions has been prepared with inputs from commercial banks, stock exchange, mall plazas and other high-end stores in the region. Notices had been issued to a large number of firms and individuals to prove that the transactions were accounted for. Actions under relevant provisions of the Income Tax Act would be taken against those found to be evading taxes, the sources maintained.