CAG pulls up Govt over ‘incorrectly’ using New Pension Scheme funds

| Date :21-Jan-2020 |

Staff Reporter :

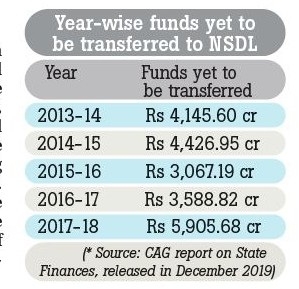

The implementation of New Pension Scheme (NPS), which was launched with much fanfare, appears to have ran into trouble. In its latest report, Comptroller and Auditor General (CAG) of India has pulled up the State Government over ‘incorrectly’ using NPS funds belonging to employees. Also, it has recommended that the amount remitted late should be remitted with a ‘reasonable rate of interest’ so that the loss to the subscribers is minimised. CAG submitted its report to the State Legislature during the winter session held in the city last month. In the audit report on State Finances, CAG has mentioned clearly that State Government “has incorrectly used the funds that belongs to its employees, leading to possible uncertainty in the rate of return to the employees/avoidable financial liability to the Government, and the eventual failure of the scheme itself.”

Government of Maharashtra adopted NPS architecture and implemented Defined Contribution Pension Scheme (DCPS) for State Government employees recruited on or after November 1, 2005. The DCPS was also applicable to employees recruited in services of recognised and aided educational institutions, non-agricultural universities, and affiliated non-Government colleges and agricultural universities, Zilla Parishads (ZPs) etc to whom the existing pension scheme and General Provident Fund Scheme was applicable. State Government joined NPS-2005 of Central Government in August 2014.

The contribution of employees (10 per cent of basic pay plus dearness allowance) along with matching contribution of employer (State Government) under Tier-I of the scheme; and the employees’ contribution above 10 per cent under Tier-II (for which there would be no matching contribution by Government) is to be transferred to the designated pension fund, through National Securities Depository Limited (NSDL)/trustee bank. However, CAG has pointed out in its report, the detailed procedure for implementation of NPS issued in April 2015 covered only State Government employees.

The orders for implementation of NPS for other employees (ZP, recognised and aided educational institutions, agricultural/non-agricultural universities, and affiliated non-Government colleges, corporations under Water Resources Department) who were part of erstwhile DCPS was to be issued later. In June 2017, Rural Development and Water Conservation Department, State Government issued detailed instructions for implementation of NPS in respect of employees in ZPs (excluding teachers).

As on 31 March 2018, there were 2,56,010 State Government employees under NPS in the State and an amount of Rs 8,145.61 crore was transferred to NSDL along with interest as applicable to GPF subscribers. As per the information furnished by State Nodal Officer to the CAG, out of 2,77,216 State Government employees, total 2,56,010 employees were registered under NPS while 21,206 employees were not registered with Central Record Agency as on March 31, 2018. The non-registration was attributed to various reasons including non-filling of subscribers’ registration form by the employees due to frequent transfer of employees of Police establishments, change in the subscribers’ registration form, rejection of subscribers’ registration form due to technical reasons, and employees being no longer in service.

During 2017-18, State Government deposited Rs 4,000.54 crore pending final transfer to the designated fund manager. This amount included employees’ contribution of Rs 1,364.20 crore (Rs 1,226.53 crore in Tier-I and Rs 137.67 crore in Tier-II), and employers’ contribution of Rs 2,636.34 crore. However, the State Government transferred only Rs 1,683.67 crore to NSDL. As on March 31, 2018, the total un-transferred amount with accrued interest was Rs 5,905.68 crore towards outstanding liabilities of the Government. The un-transferred amount mainly pertained to employees of ZP teachers, recognised and aided educational institutions, agricultural/non-agricultural universities, and affiliated non-Government colleges, corporations under Water Resources Department as the Government had ‘not issued specific orders’ for implementation of NPS for these employees. As such, CAG has pointed out, “The current liability stands deferred to future years.”

Further, it observed in the audit report, State Government has created interest liability on the amount not transferred to NSDL.” Based on the findings, CAG has recommended to the State Government ‘to ensure’ that Government contribution is fully matched with that of employees’ contribution and that the entire amount, if transferred to NSDL in a timely manner, would avoid unlimited liability on the State exchequer as well as provide an assurance to the pensioners about the returns on their investment. Also, it has recommended that the amount remitted late should be ‘remitted with a reasonable rate of interest’ so that the loss to the subscribers is minimised.