RBI holds interest rates; projects positive GDP growth

05 Dec 2020 11:47:25

Economy recuperating fast and would return to positive growth in the current quarter itself, says RBI RBI keeps benchmark repo rate unchanged at 4 pc and reverse repo rate at 3.35 pc

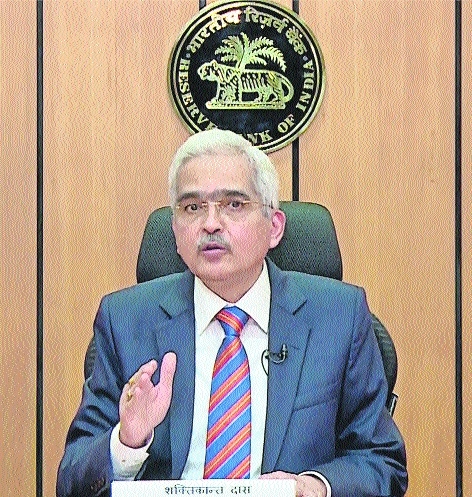

RESERVE Bank of India (RBI) on Friday left interest rates unchanged for the third straight time amid persistently high inflation and said the economy was recuperating fast and would return to positive growth in the current quarter itself.

The six-member Monetary Policy Committee (MPC) unanimously decided to keep the benchmark repo rate — the rate at which RBI lends to commercial banks — at 4 per cent. Since January, RBI has reduced that rate by 115 basis points before hitting the pause button in August on concerns on inflation.

The reverse repo rate, or the rate at which banks lend to the central bank, was kept unchanged at 3.35 per cent. The MPC “decided to continue with the accommodative stance of monetary policy as long as necessary — at least through the current financial year and into the next year,” Governor Shaktikanta Das said. The central bank’s stance is “to revive growth on a durable basis, and mitigate the impact of COVID-19 while ensuring that inflation remains within the target going forward,” he added.

Das said inflation continues to be sticky. Consumer-price growth or the headline CPI inflation, at 7.6 per cent in October, was well above the upper end of the RBI’s 2-6 per cent target band and it expected the outlook for inflation to worsen. RBI sees price gains in the fiscal third quarter at 6.8 per cent and easing a bit to 5.8 per cent in January-March. Supply-side factors, such as unseasonal rains, labour shortages, higher services prices, higher commodity prices and higher taxes have contributed to a spike in both headline and core inflation.

With no change in the repo rate and reverse repo rate by the central bank, the likelihood of an immediate reduction in borrowers’ loan EMIs is less. On the other hand, no change in policy rates means good news for FD investors as banks may not cut interest rates on FDs any further. He also announced measures to deepen the corporate bond market and supervisory measures for the shadow banking sector.

RBI raised the limit of contactless card transactions to Rs 5,000 per usage from the current Rs 2,000, with effect from January 1. Also, real-time gross settlement systems (RTGS) will be available 24x7 in the next few days, he said. Das said RBI will undertake closer scrutiny and auditing of shadow lenders and large urban co-operative banks in a bid to improve supervision of the financial sector. It will implement risk-based audits at NBFCs and urban co-operative banks that focus on localised lending. The tighter scrutiny comes after the bankruptcy of two major finance firms and the rescue of a couple of banks rocked the financial sector.

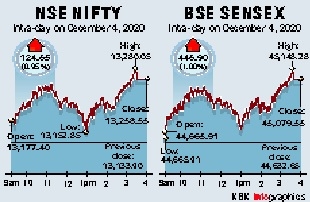

Sensex scales 45,000-mark for first time MUMBAI, Dec 4 (PTI)

EQUITY benchmarks rallied to record highs on Friday after the RBI left the policy rates unchanged but maintained its accommodative stance and revised upwards the growth forecast for this fiscal.

Breaching the 45,000-mark for the first time, the 30-share BSE Sensex surged 446.90 points or 1 per cent to finish at 45,079.55. Intra-day, it touched a lifetime peak of 45,148.28. Similarly, the broader NSE Nifty touched a new high of 13,280.05 during the session, before finishing 124.65 points or 0.95 per cent higher at 13,258.55 -- its record closing high. Rate-sensitive banking, financials, realty and auto stocks rallied after the policy announcement.