‘Indian Economy to grow 6-6.8% next fiscal year’

| Date :01-Feb-2023 |

NEW DELHI,

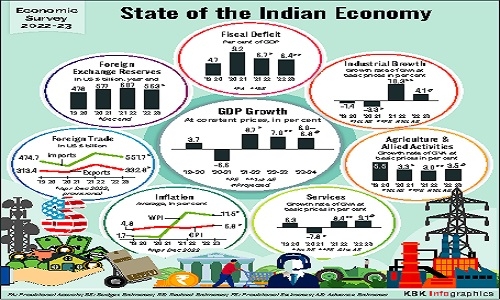

INDIA'S economy is projected to slow to 6-6.8 per cent in the fiscal year starting April - still remaining the fastest growing major economy in the world - as extraordinary challenges facing the globe will likely hurt exports, the Economic Survey said on Tuesday. The projection of India's gross domestic product (GDP) growth is higher than the 6.1 per cent estimate of the International Monetary Fund (IMF) and compares with the survey's estimated 7 per cent expansion in the current fiscal year (April 2022 to March 2023) and 8.7 per cent in the previous year.

The survey that details the state of the economy was tabled in Parliament by Finance Minister Nirmala Sitharaman a day before she presents Union Budget 2023-24. "At least three shocks have hit the global economy since 2020," the report, prepared by Chief Economic Advisor V Anantha Nageswaran, said.

Starting with the pandemic-induced contraction of the global output, the Russian-Ukraine conflict last year led to a worldwide surge in inflation. And then, central banks across economies led by the US Federal Reserve responded with synchronised policy rate hikes to curb inflation. The rate hike by the US Fed drove capital into the US markets causing the US dollar toappr eciate against most currencies. This led to the widening of the Current Account Deficits (CAD) and increased inflationary pressures in net importing economies like India. "The Indian economy, however, appears to have moved on after its encounter with the pandemic, staging a full recovery in FY22(April2021 to March 2022) ahead of many nations and positioning itself to ascend to the pre-pandemic growth path in FY23. "Yetin the current year,India has also faced the challenge of reining in inflation that the European strife accentuated," the survey said. However, the challenge of the depreciating rupee, although better performing than most other currencies, persists with the likelihood of fur ther in creases inpolicyrates by the US Fed. The widening of the CAD may also continue as global commodity prices remainelevatedand the growth moment umof the Indian economy remains strong, it said. The survey stated that the inflation projection by RBI at 6.8 per cent for current fiscal (FY23) is above the central bank's tolerance limit but the paceofpriceincreaseisnothigh enough to deter private consumption or low enough to weaken investment. According to the survey, the pressure on the Indian rupee couldcontinueduetothetighteningofmonetary policy. CAD may also remain elevated as importscouldremainhighdue toastronglocaleconomywhile exports ease due to weakness in the global economy. India'sCADwas 4.4per cent ofGDPinJuly-Septemberperiod, higher than 2.2 per cent a quarter ago and 1.3 per cent a year ago, as rising commodity prices and a weak rupee increased the trade gap. The survey said there has been an improvement in employment conditions in India due to stronger consumption but a pick-up in private investment is essential to creating more jobs. "The loss of export stimulus is further possible as the slowing world growth and trade shrinks the global market size in the second half of the current year." It indicated that while in flationmaynotbe too worrisome, borrowing costs are likely to remain 'higher for longer' as an entrenched inflation may prolong the tightening cycle. India's recovery from the pandemicwasrelativelyquick, growth will be supported by solid domestic demand, pickup in capital investment, the survey saidbuthighlightedthe challenge to the rupee with the likelihood of further interest rate hikes by the US Fed. "The survey projects a baselineGDPgrowthof6.5percent in real terms in FY24," the report said. "The actual outcome for real GDP growth will probably lie in the range of 6 per cent to 6.8 per cent, dependingonthe trajectory of economic and political developments globally." CADmay continue towiden as global commodity prices remain elevated and because of strong economic growth momentum. If CAD widensfurther, the rupee may come underdepreciationpressure,it said, adding the overall external situation will remain manageable. Onexports,itsaidthegrowth moderated in the second half of current fiscal year. Slowing world growth, shrinking global trade led to loss of export stimulus in the second half of the current year. India's economic growth in FY23 has been principally led by private consumption and capitalformation.Ithashelped generate employment as seen in the declining urban unemploymentrateandinthe faster net registration in the Employee Provident Fund. "Still, private capex soon needstotakeuptheleadership role to put job creation on a fast track," the survey said. Aslowdowninglobalgrowth will likely push down global commoditypricesandimprove India'sCADinFY24."However, a downside risk to the Current Account Balance stems from a swift recovery driven mainly by domestic demand and, to a lesser extent, by exports," it said. "The CAD needs to be closely monitored as the growt hmomentumofthe current year spills over into the next." ECONOMIC SURVEY PRESENTS COMPREHENSIVE ANALYSIS OF INDIA’S GROWTH TRAJECTORY: PM MODI: PRIME Minister NarendraModionTuesdaysaid the Economic Survey 2022-23 presents a comprehensive analysis of India’s growth trajectory, including the global optimism towards the country. Modi tweeted, “The Economic Survey presents a comprehensive analysis of India’s growth trajectory including the globaloptimism towards our nation, focus on infra, growth in agriculture, industries and emphasis onfuturistic sectors.” India’s economy is projected to slow to 6.5per centinthefiscal year starting April but will remain the fastest growing major economy in the world as it fare dbetterindealing with the extraordinary set of challenges the globe has faced,theEconomic Survey said