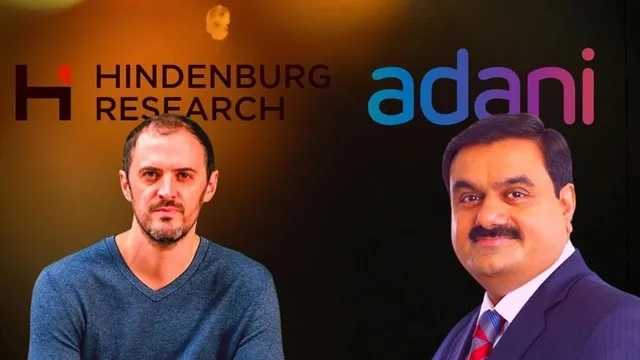

HINDENBURG, which targeted Adani, SHUTS SHOP

17 Jan 2025 10:31:17

WASHINGTON/NEW DELHI,

HINDENBURG Research, which made

international waves with campaigns targeting billionaire Gautam Adani that

wiped billions from market value of his

group companies, will disband, its founder

Nate Anderson announced on Thursday.

Announcement by Anderson, 40, who

started Hindenburg in 2017, came just days

before Donald Trump’s inauguration as

the new President of the United States.

While he cited the toll of the “rather

intense, and at times, all encompassing”

nature of the work as the reason for his

decision”, critics were quick to link the

shutting down Hindenburg’s alleged ties

with George Soros and the so-called deep

state being under significant pressure

from the incoming Trump administration.

Adani Group CFO Jugeshinder Robbie

Singh in a cryptic post on X said: “Kitne

Ghazi Aaye, Kitne Ghazi Gaye”

Typically, short-sellers like Anderson,

who managed his firm’s own money but

not that of others, bet against companies

they believe are plagued with mismanagement or involved in some fraud/scam.

Short sellers borrow a stock to sell it in

the expectation the price will fall, then

repurchase the shares and pocket the difference.

They book loss if the reverse happens.

Hindenburg in January 2023 published

a report accusing the Adani group of

“pulling the largest con in the corporate history”, wiping out more than

USD 150 billion in value of the

group’s shares at their lowest

point. Adani group vehemently

denied all the allegations

including that being “engaged

in a brazen stock manipulation

and accounting fraud scheme

over the course of decades”

and improper use of offshore

tax havens to shore up group

share prices.

Business tycoon Adani was

ranked world’s fourth-richest

and Asia’s wealthiest person a

day before the report was published. He slipped following

the heavy selling witnessed in

the group stocks. OnThursday,

with a net worth of USD 75 billion, he was ranked at No.20,

behind Mukesh Ambani

(ranked 17th with USD 91.5

billion net worth).

“There is not one specific

thing - no particular threat, no

health issue and no big personal issue,” Anderson wrote

in a letter posted on the firm’s

website.

“The intensity and focus has

come at the cost of missing a

lot of the rest of the world and

the people I care about. I now

view Hindenburg as a chapter

in my life, not a central thing

that defines me.”

A graduate of international

business management from

the University of Connecticut,

Nathan (Nate) Anderson

founded a “forensic financial

research” firm to specialise in

spotting wrongdoings and

frauds, or what it calls manmade disasters, at companies

around the globe and taking

market bets against them.