Fear + Confusion = Profit How scamsters earn big from ‘Digital Arrest’

| Date :05-Nov-2025 |

By Dheeraj Fartode

Case 1: A 42-year-old woman from Dharampeth received a WhatsApp call from someone posing as ‘Cyber Cell Officer’. He threatened that a parcel in her name had drugs. The woman feared for arrest and transferred Rs 3.8 lakh. Later she realised it was a digital arrest scam.

Case 2: A 29-year-old IT employee from Pratap Nagar was told his Aadhaar was linked to a money laundering racket. ‘Agents’ on a video call made him sit for hours as part of an interrogation and forced him to keep phone camera on. They forced him to transfer Rs 2.1 lakh on-line. A complaint was registered at Cyber PS.

Case 3: A retired Railways clerk from Jaripatka got a call that his KYC had failed and a court warrant was issued. Fraudsters posed as NCB officers and demanded bail amount. He paid Rs 4.5 lakh through UPI. Later, when no acknowledgement was received, he approached Sitabuldi Police.

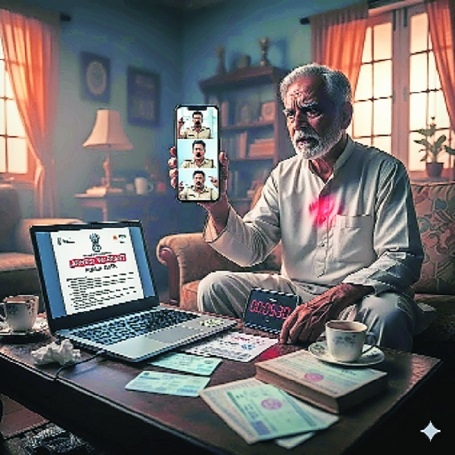

These cases clearly show how cyber crooks are targeting common people online and making money through the dangerous ‘digital arrest’ scam. In this fraud, scamsters pretend to be police, CBI, NCB, Customs or RBI officers. They tell victims that their Aadhaar, PAN or bank account is linked to illegal activity and threaten them with arrest. Out of fear, many innocent citizens fall into the trap and transfer money.

This method is called ‘digital arrest’ because the fraudsters keep the victim on

video call for hours like interrogation. The person cannot move away or switch off the phone due to fear and confusion. Fraudsters show fake ID cards and fake warrant papers. They also send PDF ‘legal notices’ and court seal images to increase pressure. The

victim starts believing everything and transfers money for ‘verification’, ‘bail’, ‘court clearance’ or ‘anti-money laundering certificate’.

10 cases in city, many unreported

According to Police Inspector Baliram Sutar of Cyber Police Station, Nagpur reported 10 digital arrest cases in the last 10 months. In most of the cases, victims were traumatised, stressed and deeply confused while the fraud was happening. Out of these, arrest

Contd from page 1 was made in four cases. Investigation continues in six cases.

Senior citizens are the easiest targets. They panic quickly when someone says their document is linked to a crime. Also, many older people do not know how to verify an official phone number. These scammers also smartly contact people during office hours so that victims cannot call family members or friends for help.

A police official said that money recovery is extremely difficult. The moment money is transferred, it is moved to multiple mule accounts in different states within minutes. Many accounts used are opened in the name of poor villagers or daily wage workers who sell their bank accounts for Rs 3,000 to Rs 5,000. These accounts are then used to route lakhs of rupees. After three or four transfers, money is taken out as cash or moved to cryptocurrency. Due to this, even when the complaint is filed on time, tracing of funds becomes complicated, the official said. First 10 minutes important Cyber police say that many victims call them only after the fraud is completed. Most people do not call the helpline in the first ten minutes when the fraud starts. That first ten minutes are important because banks can freeze the transaction immediately in suspicious transfers. After money leaves the first account, recovery chances reduce to almost zero.

Police Inspector Sutar has again appealed to citizens that no Government officer will ever demand money on-line or on WhatsApp video call. Police do not arrest anyone through phone call. If anyone receives such calls, they must immediately cut the call and dial 1930 cyber helpline.